Back to the basics.

A Regular Checking account at Interra gives you an easy and simple option.

- Simple checking.

- Receive a free debit card (usually available at time of account opening).

- Enjoy unlimited check writing.

- Take advantage of state-of-the-art electronic services.

Have questions regarding the recent checking account changes? Scroll to the helpful FAQ below.

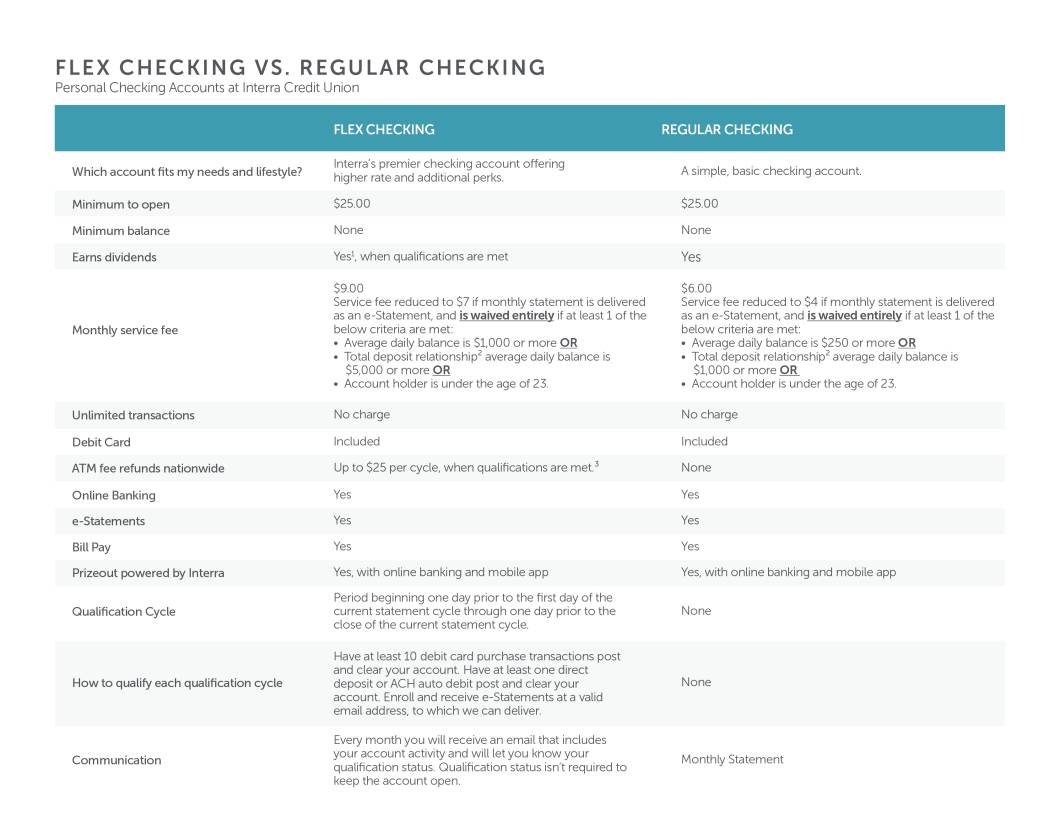

What is the minimum opening balance for a Regular Checking account?

$25.00, but remember, there is no minimum balance required once your account is open.

Can the APY change on a Regular Checking account?

Yes, all rates on Regular Checking may change at Interra Credit Union’s discretion.

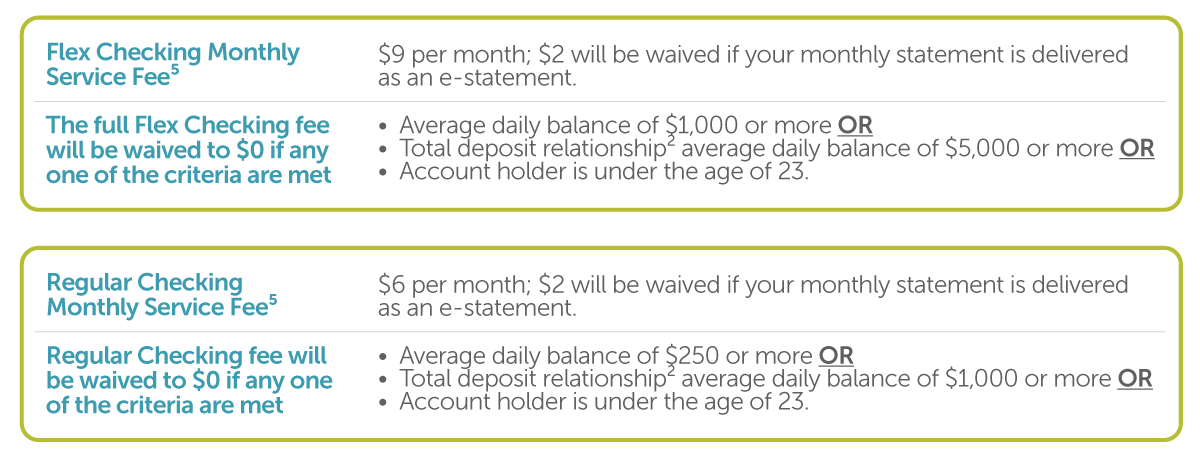

How can I reduce or avoid the service fee?

Interra is committed to providing alternatives and options for our members allowing potential service fees to be entirely waived to $0.

What does “total deposit relationship” mean?

A total deposit relationship refers to the combined balances of all savings, checking, money market and share certificate balances per membership account number. Loans and investments held through Interra Wealth Services (LPL Financial) and are not included in the total deposit relationship.

Will I receive a service fee each month?

Accounts will be evaluated on a monthly cycle. If at least one of the criteria is met (see above for the criteria), there will be no service fee for that month.

Is overdraft protection available for Regular Checking accounts?

Yes, if the account qualifies.

What if I want to adjust my checking account?

If you would like to adjust your checking account to a different one that better meets your banking needs, you can do this in your online banking. Follow these 4 steps once logged in.

- From the Menu, select Secure Forms.

- Select Checking Account Converter.

- Choose an option from the “I would like to convert my checking to a . . .”.

If you have more than one checking account, be sure to define the share suffix that correlates to your checking account that should be changed. - Click Submit.

1APY effective as of March 1, 2024, and subject to change without notice. Fees may reduce earnings on the account. $25.00 minimum opening balance. Rate tiers: Bonus Rate 1: 1.00% APY on balances of $0.01-$10,000.00 and 25+ debit card purchases per cycle; Bonus Rate 2: 0.50% APY on balances of $0.01-$10,000.00 and 10-24 debit card purchases per cycle; Second Tiered Rate: 0.15% APY on balances over $10,000.00 and at least 10 debit card purchases per cycle; Base Rate: 0.01% APY applies to all balances if qualifications are not met. The monthly statement will reflect a blended APY if you have balances in different tiers. Dividends are variable based on tier and dependent on all qualifications being met. 2 Total deposit relationship includes all savings, checking, and share certificate balances per membership account number. Loans or investments held through LPL Financial are excluded. Each checking account will be subject to the monthly account fee. Monthly service fee will be imposed on the last day of each month. Each checking account you may have will be subject to the service fee. 3ATM fee refunds up to $25.00 are provided only if qualifications are met within the qualification cycle. Fee refunds are only applied to withdrawals made from the Flex Checking account. ATM surcharges over $4.99 are not automatically refunded but may be manually refunded by a credit union representative with the presentation of a receipt within 10 business days following the month that the Flex Checking qualifications were met. 5Monthly service fee will be imposed on the last day of the month. Each checking account you may have will be subject to the service fee.