If you’re Goldilocks, we’re the bear with

the account that’s just right.

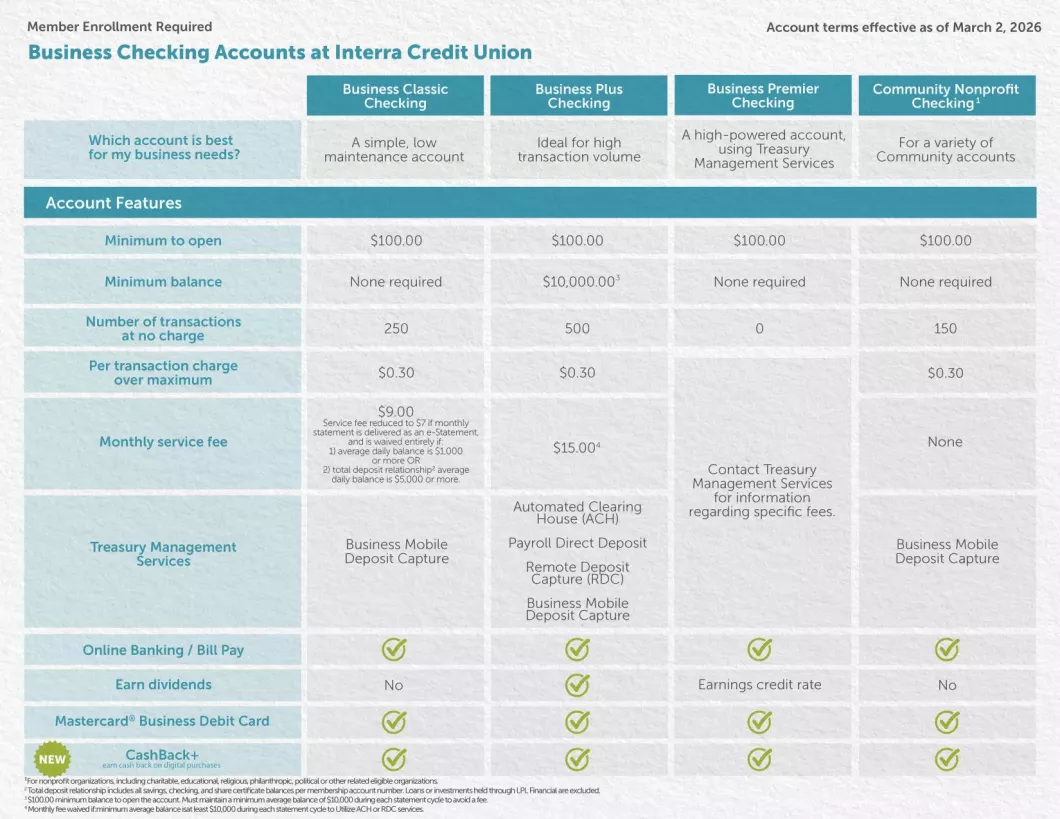

We have the right checking accounts for small, medium or large businesses.

Interra offers checking programs for your unique business needs.

- See above chart for a variety of account options

- Free debit card

- Online Banking, bill pay, and more

- Business money market share account

- Overdraft protection options available

Can I get a printed copy of a business check image?

Yes, you can print a copy of a check via Interra Online Banking.

Will Business Checking members receive a 1099 at the end of the year reflecting dividends earned?

Yes, if applicable.

Can the APY change on a Business Checking account?

Yes, all rates on dividend earning Business Checking accounts may change at Interra Credit Union’s discretion.

What is the minimum opening balance for a Business Checking account?

$100 to open all accounts.