Flex Checking

Looking for a high yield checking account? You found it.

With Flex Checking you can earn up to 1.00% Annual Percentage Yield (APY) when qualifications are met. Flex Checking is a tiered rate account. What does that mean? It means that your checking account will flex with you depending on how you spend!

Flex Checking offers

- 1.00% APY1 when 25+ debit card purchases post and clear your account each qualification cycle.

- .50% APY1 when 10-24 debit card purchases post and clear your account each qualification cycle.

- High rate paid on balances up to $10,000.1

- ATM fee refunds nationwide - up to $25 per qualification cycle.3

- No minimum balance.

- Automatically qualify the month you sign up.

It's easy to qualify each cycle

- Have the required debit card purchases post and clear your account each qualification cycle.4

- Have at least one direct deposit or an ACH auto debit post and clear your account.

- Enroll in and receive e-Statements at a valid e-mail address to which we can deliver.

What is the minimum opening balance for a Flex Checking Account?

$25.00, but remember, there is no minimum balance required once your account is open.

What is the qualification cycle?

The qualification cycle is a period beginning one day prior to the first day of the current statement cycle through one day prior to the close of the current statement cycle. For example, a qualification cycle beginning September 30 would end October 30. The next qualification cycle would begin October 31 and end November 29. All other qualification cycles would follow this same pattern.

What happens if I do not meet the qualifications for Flex Checking?

Don’t worry. With Flex Checking you can flex between qualifying tiers. You can start over during the next qualification cycle. The Base Rate is paid when the Flex Checking qualifications are not met.

What if the account balance is below $10,000?

You're in luck! The rate applies to any balance up to $10,000.

What if the account balance is above $10,000?

You'll still earn 0.15% APY.

If my account balance goes negative, will I still be able to qualify for dividends during that monthly statement cycle?

Yes, as long as you meet the qualifications.

Can the APY change on my Flex Checking account?

Yes, all rates on Flex Checking may change at Interra Credit Union’s discretion.

How is the dividend calculated?

Daily Balance Method. This method applies a daily periodic rate to the balance in the account each day.

How is the Annual Percentage Yield (APY) calculated?

We are required to disclose an Annual Percentage Yield (APY) which is based on an annual return. The APY is a calculation of the yield you should receive over an exact year. This is a tiered account and if you have account balances in different tiers with different dividend rates, the APY will be blended on your monthly statement.

Example: your account balance is $110,000; $10,000 earns an interest rate of 2.00% and the remaining $100,000 earns an interest rate of .30%.

$10,000 X 2.00% = 200.00 (annual interest earned)

$100,000 X .30% = 300.00 (annual interest earned) Total =500.00 ÷ 110,000 =.45% APY

If I meet the qualifications, when will I receive my dividends?

Dividends are paid monthly and posted on the last day of each statement cycle.

How do the ATM refunds work?

If the qualifications are met, all ATM fees up to $25 nationwide will be refunded on the last day of each monthly statement cycle. The refunds include surcharge and foreign transaction fees. Only fees assessed for ATM withdrawals made from the Flex Checking account will be refunded. International ATM fees will not be refunded.

ATM surcharges in excess of $4.99 are not automatically refunded, but may be manually refunded by a credit union representative with the presentation of a receipt within 10 business days following the month that the Flex Checking qualifications were met.

If I use my MasterCard® debit card at an ATM, will that transaction count towards my qualifications?

No. Only debit purchase transactions count toward the qualified transactions.

What is a “settled transaction”?

A settled transaction is one that has posted to your account. When you use your MasterCard debit card, the merchant places a memo hold on your account in the amount of your purchase. It can take up to three business days before the transaction posts or clears.

May I “carry forward” debit purchases in excess of the required number to the next qualification cycle?

No, you must meet all of the requirements each qualification cycle.

How do I set up a direct deposit?

Direct deposit is a process through which a payor (company/organization/agency) deposits funds directly into your account, rather than issuing a paper check. In order to do this, you must provide the payor with your 10-digit Flex Checking account number and the credit union's routing number 271291017.

What is an ACH auto debit?

Short for Automated Clearing House Network, it is an automatic payment you set up to be directly deducted from your account. It may be a regular insurance premium, utility payment or other type of payment. Because some Interra Bill Pay payments are processed via ACH, they would meet this qualification. However, processing methods are subject to change without notice.

Must I access my e-Statement online in order to qualify for the dividend?

You must accept electronic delivery with a valid e-mail address to which we can deliver. Otherwise, there is a $5 paper statement fee. We strongly recommend that you review your statement monthly to properly reconcile to your check register.

Can I have a Flex Checking account if I don’t own a computer?

Yes, of course! You don’t have to own a computer, but you must provide a valid e-mail address for notification of availability of each e-Statement.

What if I need a printed copy of my statement and/or check image?

You can print a copy of a check or statement via Interra Online Banking when you sign up for e-Statements.

What if I change my email address?

You must notify the credit union when your e-mail address changes so that we can deliver the notifications of your statement availability.

Flex Checking Communications

You will receive a “Welcome” e-mail from Interra Credit Union (msg@interracu.com). The subject line will be: Flex Checking. Be sure to save this e-mail address on your approved e-mail address list. At the end of each qualification cycle, you will receive an e-mail from the above address and subject. It will include your account activity based on the requirements and let you know if you qualify or do not qualify. If you do not qualify one month, don’t worry. You will be starting a new cycle and a new opportunity to earn dividends.

Will Flex Checking members receive a 1099 at the end of the year reflecting dividends earned?

Yes, if applicable.

Is overdraft protection available for Flex Checking accounts?

Yes, if the account qualifies.

Can I open multiple Flex Checking accounts?

You may have up to two (2) Flex Checking accounts, but the qualifications must be met on each respective account.

Can a sole proprietor or DBA use this account?

No, only personal accounts qualify.

Can this be used as a business account?

No, only personal accounts qualify.

Where can I view how many qualified debit card transactions I’ve made?

You can view the number of qualified debit purchase transactions each cycle on the Flex Checking summary page in Interra Online Banking.

Where can I view how many qualified debit card purchases I've made?

In Online Banking you can view the number of qualified debit card purchases under your Flex Checking account.

What if I don’t want e-Statements?

There is a $5.00 paper statement fee assessed each month you do not receive e-Statements.

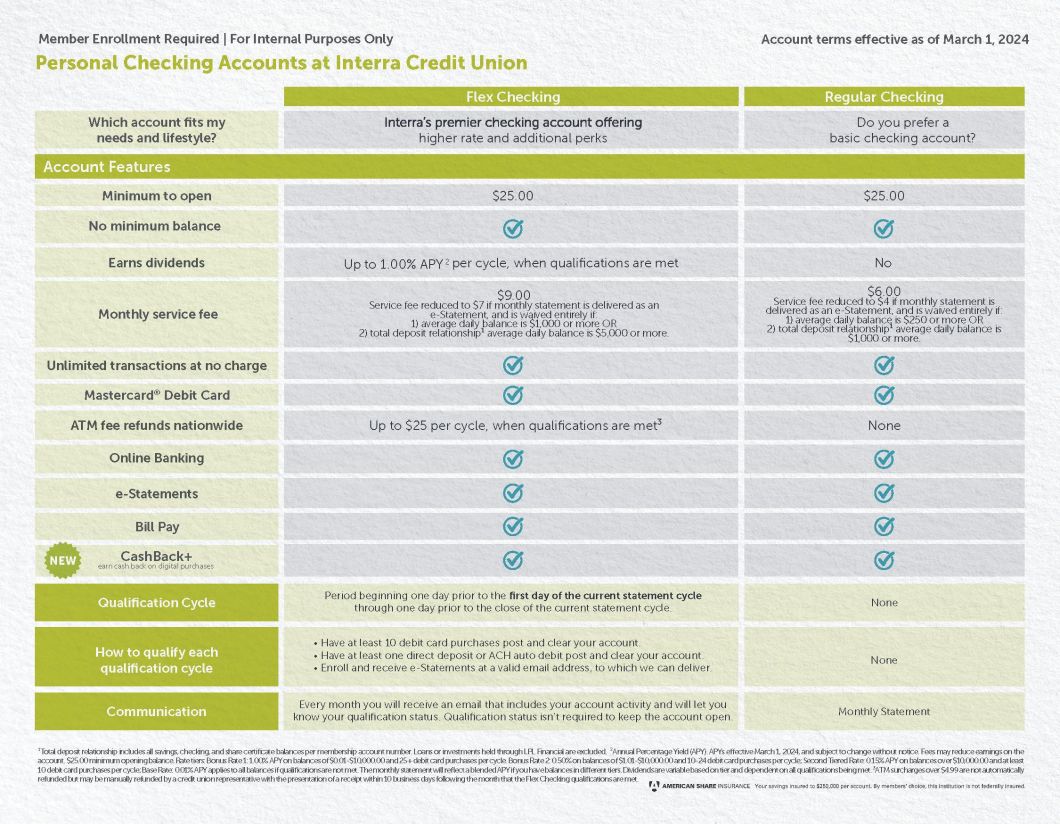

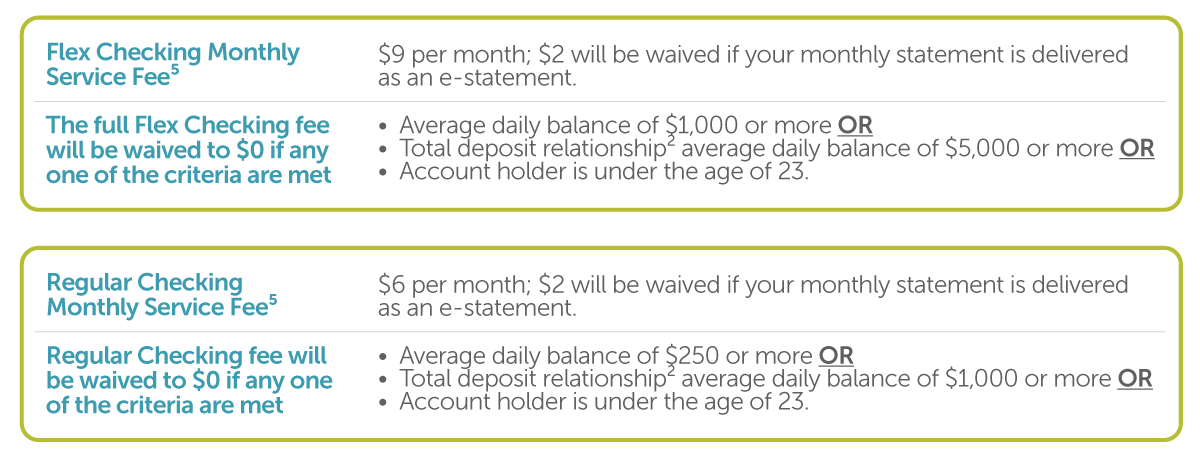

How can I reduce or avoid the service fee?

Interra is committed to providing alternatives and options for our members allowing potential service fees to be entirely waived to $0.

What does “total deposit relationship” mean?

A total deposit relationship refers to the combined balances of all savings, checking, money market and share certificate balances per membership account number. Loans and investments held through Interra Wealth Services (LPL Financial) and are not included in the total deposit relationship.

Will I receive a service fee each month?

Accounts will be evaluated on a monthly cycle. If at least one of the criteria is met (see above for the criteria), there will be no service fee for that month.

What if I want to adjust my checking account?

If you would like to adjust your checking account to a different one that better meets your banking needs, you can do this in your online banking. Follow these 4 steps once logged in.

- From the Menu, select Secure Forms.

- Select Checking Account Converter.

- Choose an option from the “I would like to convert my checking to a . . .”

If you have more than one checking account, be sure to define the share suffix that correlates to your checking account that should be changed. - Click Submit.

What Makes a Credit Union Different?

Interra Credit Union is a member-owned, not-for-profit financial cooperative (also called a co-op). This means that our members pool their savings, borrow, and obtain related financial services together. Members are therefore united by a common bond and democratically operate the credit union.

1APY effective as of March 1, 2024, and subject to change without notice. Fees may reduce earnings on the account. $25.00 minimum opening balance. Rate tiers: Bonus Rate 1: 1.00% APY on balances of $0.01-$10,000.00 and 25+ debit card purchases per cycle; Bonus Rate 2: 0.50% APY on balances of $0.01-$10,000.00 and 10-24 debit card purchases per cycle; Second Tiered Rate: 0.15% APY on balances over $10,000.00 and at least 10 debit card purchases per cycle; Base Rate: 0.01% APY applies to all balances if qualifications are not met. The monthly statement will reflect a blended APY if you have balances in different tiers. 2 Total deposit relationship includes all savings, checking, and share certificate balances per membership account number. Loans or investments held through LPL Financial are excluded. Each checking account will be subject to the monthly account fee. 3ATM fee refunds up to $25.00 are provided only if qualifications are met within the qualification cycle. Fee refunds are only applied to withdrawals made from the Flex Checking account. ATM surcharges over $4.99 are not automatically refunded but may be manually refunded by a credit union representative with the presentation of a receipt within 10 business days following the month that the Flex Checking qualifications were met. 4Dividends are variable based on tier and dependent on all qualifications being met. 5Monthly service fee will be imposed on the last day of each month. Each checking account you may have will be subject to the service fee.